Hi,

In June this year, the European Central Bank has taken a range of measures aimed at reinvigorating the European economy, in response to declining inflation and negligible economic growth. One of the tools used was the introduction of a program known as TLTRO, whose target expected to be approx. nearly 400 billion euros, and the program should be directed to the recovery in lending in the Eurozone, and thus have a positive impact on the real economy.

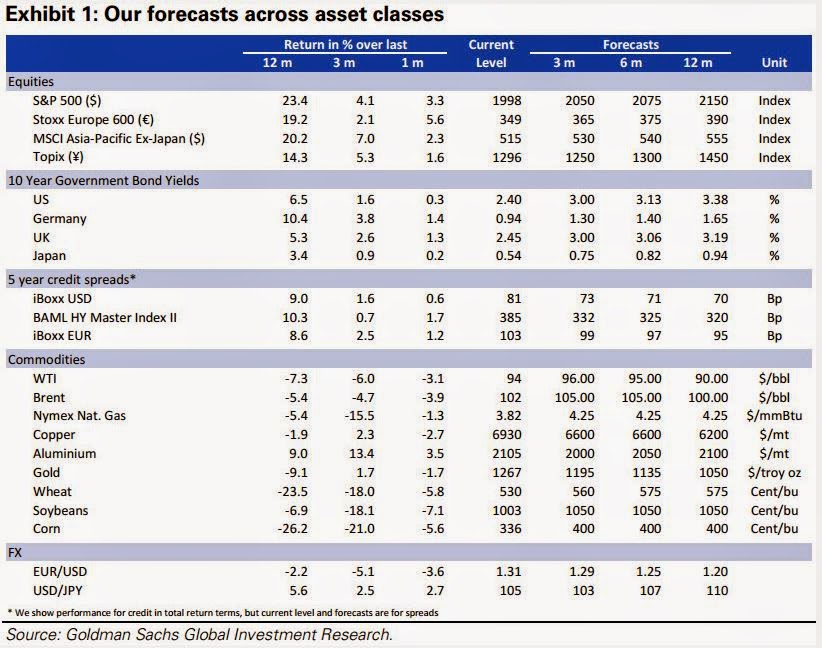

I'll start with the following graphic showing who and how much borrowed during the auction TLTRO:

|

| graph 1. September TLTRO Take-up |

What's this TLTRO ?

- Long-term loans to commercial bank;

- Value of the program ultimately is expected to be approx. 400 billion EUR;

- Loans will be taken in September 2018;

- The value of loans to individual banks, will be determined from the increase in the value of each bank consumer lending;

- In the event that the banks did not increase lending, will have to repay the loan earlier;

- The interest rate of new loans for the TLTRO will be constant and will reach MRO of the start date of the loan plus 10 basis points. margin;

- Each bank will be able to borrow a value not exceeding 7% of its total lending as of 30 April 2014. (In the amount of credit will not be counted for the financial sector loans and mortgages);

- As part of the loan gets even restrictions that make loans to hit the real economy sector.

Published last week, data relating to the first allocation of loans TLTRO disappointing showing by the way, that the problem in the euro area is much more serious and is not limited to a temporary lack of liquidity in the banking sector.

According to economists, the main problem of European Eurozone is low demand for loans in the economy, which is reflected in the effectiveness of the programs implemented by the ECB. In the first tranche only TLTRO banks took 82.6 billion, plus economists interviewed by Reuters predict that in December, the second tranche is expected to be 175 billion euros. Summing up the two tranches, we can see that the 400 billion euros by the ECB offered nearly 30% of the amount will not be used. To not be limited only to the current data, it is worth comparing it with the programs introduced during the acute phase of the crisis in the euro zone, which resulted absorbed by the banking sector over one trillion (!) Euros.

European Central Bank is slowly beginning to end with the tools that it could affect the real economy. In the words of Mario Draghi interest rates in the euro area have already reached the lower limit and it is technically impossible to make them even lower. This gives banks a clear message - use and lend, because they will not be cheaper. The problem is that these actions are connected with others, introduced by the ECB at the same time, which can cause some indecision in the market and reduce their effectiveness. Loans targeted at the private sector falling for nearly two years, and since the introduction in June TLTRO improvement in this sector practically does not occur.

In summary, the actions of the ECB in recent months have led to increases in the stock market and the weakening of the European currency, but had little impact on the real economy, which inhibits the growth of both inflation and economic growth will faint. Because of this, the ECB may be forced to take further decisions, for example. Introduction of a broader QE in the form of buying government bonds, but the impact of such measures on the real economy would be even smaller than TLTRO program. In addition, it would delay fiscal reforms in the euro area, due to the lower costs of debt issuance, which are strongly opposed to Germany.

Mario Draghi will give an interview today.

After his words, it can be concluded that the European economy is doing so badly that significantly increased the likelihood of extension of the program buying ABS, additionally on government bonds.

regards,

oscarjp