hello All,

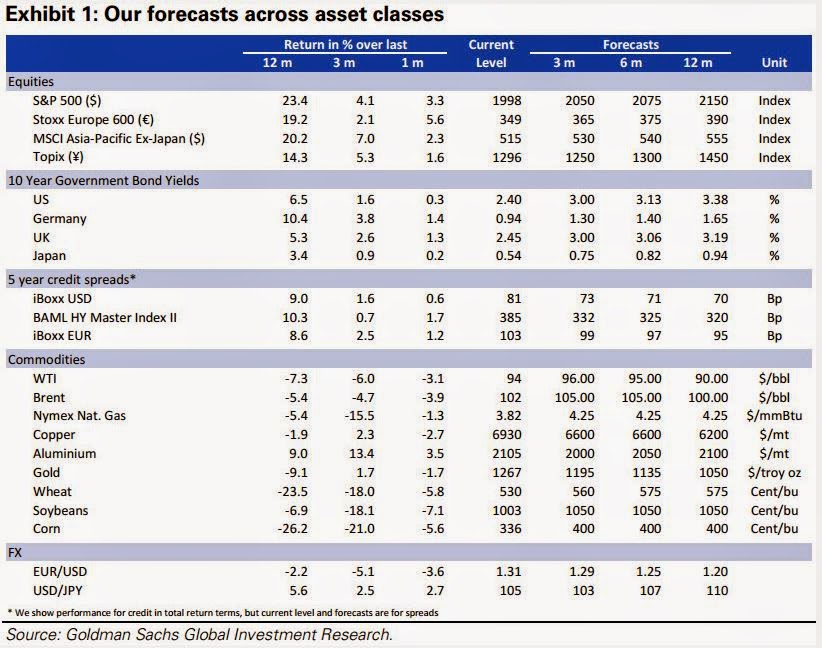

In today's entry I'm going to present the latest forecasts Goldman Sachs regarding the most interesting financial markets of the world.

In a recent report, Goldman recommends upgrading equities to overweight for the next 3 months, rolling index targets forward, and piling investors into high-yield credit.

"We upgrade equities to overweight over 3 months, in line with our 12-month view. We have rolled our index targets forward to higher levels for all regions except Japan and, following the dovish ECB decisions yesterday, we now see the risk to equities from higher bond yields as less imminent. We maintain a high conviction that yields will rise from here, but since our last GOAL, risks have clearly shifted in the direction of a slower path. Today we re-iterated our yield forecast for the US, UK and Japan and lowered our year-end Bund forecast from 1.60% to 1.30%"

Goldman recommended asset allocation:

Equities: "We are overweight over both 3 and 12 months. We expect earnings growth, dividends, and high risk premia to support returns."

Commodities: "We are neutral over both 3 and 12 months but expect significant dispersion below the index level. We like nickel, palladium, zinc and aluminium, but see downside for copper and gold. Roll carry is likely to contribute significantly to returns, especially for oil, copper and aluminium."

Corporate credit: "We remain underweight over both 3 and 12 months. We expect spreads to narrow, but given already tight levels, rising government bond yields are likely to dominate the returns, especially for US IG credit. The exception is US HY, and within credit we would recommend an overweight in HY relative to IG."

Government bonds: "We remain underweight. We expect yields to rise due to sustained high US growth and accelerating inflation, a decline in deflation concerns in Europe, and support to inflation expectations from ECB policy action."

Equities: "We are overweight over both 3 and 12 months. We expect earnings growth, dividends, and high risk premia to support returns."

Commodities: "We are neutral over both 3 and 12 months but expect significant dispersion below the index level. We like nickel, palladium, zinc and aluminium, but see downside for copper and gold. Roll carry is likely to contribute significantly to returns, especially for oil, copper and aluminium."

Corporate credit: "We remain underweight over both 3 and 12 months. We expect spreads to narrow, but given already tight levels, rising government bond yields are likely to dominate the returns, especially for US IG credit. The exception is US HY, and within credit we would recommend an overweight in HY relative to IG."

Government bonds: "We remain underweight. We expect yields to rise due to sustained high US growth and accelerating inflation, a decline in deflation concerns in Europe, and support to inflation expectations from ECB policy action."

The assessment of the above recommendations will leave you to your own analysis.

regards,

oscarjp

The information contained in this publication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Any opinion offered herein reflects oscarjp-chrimatistikos current judgment and may change without notice. Users acknowledge and agree to the fact that, by its very nature, any investment in shares, stock options and similar and assimilated products is characterised by a certain degree of uncertainty and that, consequently, any investment of this nature involves risks for which the user is solely responsible and liable.

No comments:

Post a Comment